Just how to Select the Right Company for Your Bid Bonds

Just how to Select the Right Company for Your Bid Bonds

Blog Article

Vital Steps to Make Use Of and get Bid Bonds Properly

Navigating the complexities of proposal bonds can substantially affect your success in safeguarding agreements. The genuine challenge lies in the meticulous selection of a respectable supplier and the strategic usage of the bid bond to enhance your competitive side.

Understanding Bid Bonds

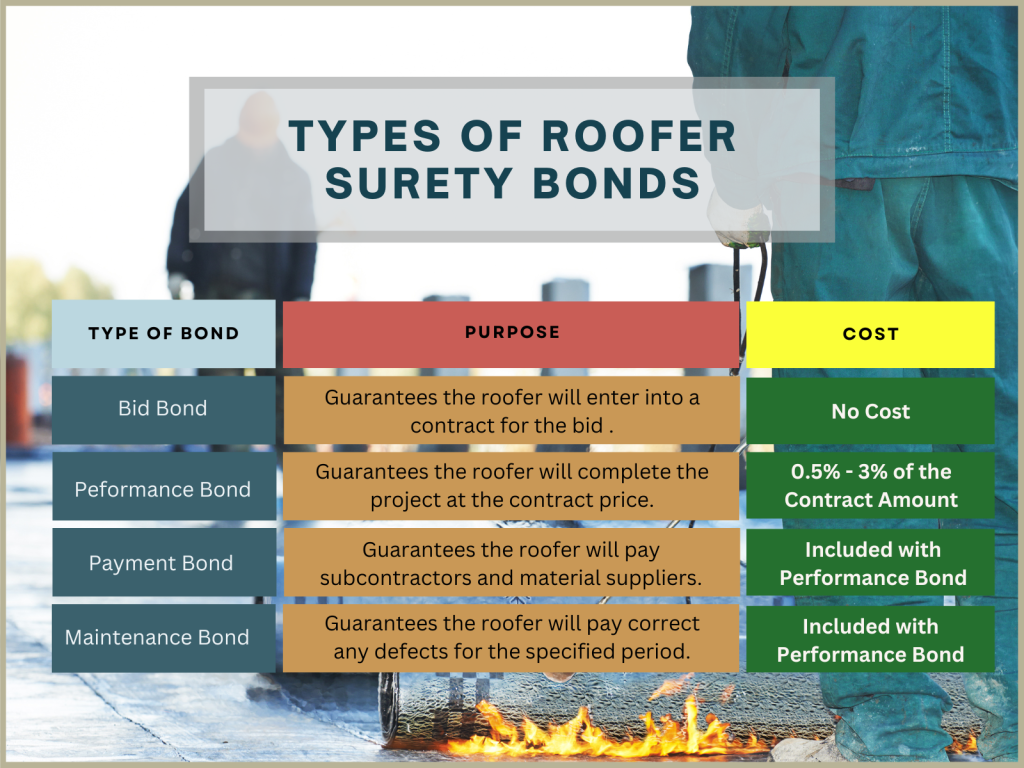

Proposal bonds are a vital element in the construction and contracting sector, working as a financial guarantee that a prospective buyer intends to participate in the contract at the quote cost if granted. Bid Bonds. These bonds mitigate the threat for job owners, guaranteeing that the chosen specialist will certainly not just recognize the quote but also protected performance and repayment bonds as needed

Basically, a quote bond serves as a protect, protecting the task owner versus the financial ramifications of a contractor failing or taking out a quote to commence the job after option. Usually provided by a guaranty firm, the bond guarantees settlement to the proprietor, typically 5-20% of the bid amount, should the contractor default.

In this context, quote bonds cultivate a much more reliable and competitive bidding process atmosphere. Proposal bonds play an indispensable role in preserving the stability and smooth procedure of the building and construction bidding procedure.

Getting Ready For the Application

When getting ready for the application of a bid bond, careful company and extensive documents are paramount. A thorough evaluation of the project requirements and proposal needs is important to make sure conformity with all stipulations. Begin by putting together all needed monetary statements, including equilibrium sheets, income statements, and cash circulation statements, to show your company's monetary wellness. These documents ought to be current and prepared by a licensed accountant to enhance trustworthiness.

Next, compile a checklist of previous projects, specifically those similar in extent and size, highlighting effective completions and any distinctions or accreditations got. This profile offers as evidence of your business's capacity and reliability. Additionally, prepare a thorough service strategy that describes your operational technique, risk monitoring practices, and any kind of contingency prepares in area. This plan offers a holistic view of your business's strategy to project execution.

Ensure that your business licenses and registrations are easily available and current. Having actually these documents arranged not only speeds up the application procedure but additionally predicts a specialist photo, instilling confidence in prospective surety suppliers and job proprietors - Bid Bonds. By systematically preparing these components, you position your business favorably for successful bid bond applications

Discovering a Guaranty Provider

Furthermore, think about the service provider's experience in your details sector. A surety business familiar with your field will certainly better recognize the special dangers and demands connected with your tasks. Request referrals and examine their background of claims and client fulfillment. It is also advisable to assess their financial rankings from companies like A.M. Best or Standard & Poor's, ensuring they have the economic toughness to back their bonds.

Engage with several suppliers to my company compare terms, solutions, and rates. A competitive examination will help you protect the most effective terms for your bid bond. Ultimately, a thorough vetting process will make certain a trusted collaboration, fostering confidence in your bids and future jobs.

Submitting the Application

Sending the application for a proposal bond is an important step that needs thorough focus to information. This process begins by gathering all relevant documents, including financial statements, job requirements, and a detailed service history. Ensuring the accuracy and efficiency of these files is paramount, as any inconsistencies can bring about delays or rejections.

When filling in the application, it is a good idea to double-check all entrances for accuracy. This Clicking Here consists of confirming numbers, making sure proper signatures, and confirming that all essential accessories are included. Any kind of errors or omissions can undermine your application, creating unneeded issues.

Leveraging Your Bid Bond

Leveraging your bid bond successfully can considerably improve your one-upmanship in protecting agreements. A quote bond not only shows your financial security yet additionally comforts the project proprietor of your dedication to meeting the agreement terms. By showcasing your bid bond, you can underline your company's reliability and integrity, making your quote attract attention amongst various competitors.

To take advantage of your proposal bond to its fullest capacity, ensure it is presented as part of a comprehensive bid package. Highlight the strength of your surety provider, as this reflects your business's financial health and wellness and functional capability. Additionally, stressing your track record of efficiently finished projects can even more instill self-confidence in the project proprietor.

Furthermore, maintaining close communication with your surety company can assist in much better terms and conditions in future bonds, hence strengthening your affordable placing. An aggressive approach to handling and restoring your proposal bonds can likewise stop lapses and guarantee constant coverage, which is vital for recurring job procurement initiatives.

Verdict

Effectively getting and making use of bid bonds necessitates thorough preparation and strategic implementation. By adequately arranging crucial documents, picking a trustworthy guaranty carrier, and submitting a full application, firms can protect the needed bid bonds to enhance their competition. Leveraging these bonds in propositions underscores the firm's integrity and the strength of the guaranty, eventually increasing the chance of securing contracts. Continual communication with the surety supplier ensures future possibilities for effective task bids.

Identifying a trusted guaranty supplier is an important action in safeguarding a proposal bond. A bid bond not only demonstrates your economic stability yet likewise assures the task proprietor of your commitment to meeting the contract terms. Bid Bonds. By showcasing your bid bond, you can underline your company's reliability and reputation, making your proposal stand out among various competitors

To utilize your bid bond to its greatest capacity, ensure it is provided as part of a comprehensive quote bundle. By adequately arranging vital paperwork, choosing a reliable surety company, and submitting a full application, firms can safeguard the essential bid bonds to boost their competitiveness.

Report this page